One of the essential components of every organization is finance. Effective financial planning may make or ruin a company. Technology is another essential element of every organization. Combining the two, the term “Fintech” has done wonders for enterprises, helping them not only manage their finances but also foresee and prepare for the future of their companies.

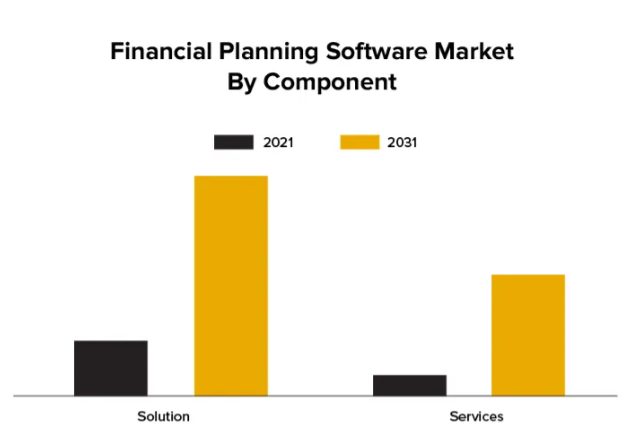

It is anticipated that in the financial planning software market, offering superior solutions would take precedence over the services industry. The explanation is straightforward: During the epidemic, financial advisory businesses communicated with their clients using social media channels. In essence, this led to the requirement for developing solutions that constantly keep investors and advisory companies informed of changes and trends in the market.

Let us look at the below statistics on the financial planning software market in 2021 & 2022

What is Financial Planning Software?

As the name implies, it alludes to software that facilitates better financial planning by combining recovered financial information from a person or an organization to get the needed analytical results. The information input into the program might come from a variety of sources, including bank records, portfolio management, investment tracking, financial transactions, and many more.

The financial planning company recognized the need for software that could track and manage the customers’ income as a result of the growth in the HNI clientele base. Customers also look for mobile application-based solutions to maintain track of their investments and value at their fingertips.

Businesses must now have reliable financial planning software that can manage their ERP efficiently and deliver good customer service in order to flourish. Strong financial planning software also makes it possible to manage information.

The Development & Advantages of Specialized Financial Planning Software

In the past, financial planning software was only a calculator that advisers used to examine their clients’ present financial situations and predict future results based on market trends. The development of financial planning software created opportunities for customers and advisers to collaborate more effectively by allowing them to evaluate real-time data and make decisions about investments immediately.

Future financial planning software development will need to concentrate specifically on each client, company, and market segment from the standpoint of carrying out the duty of the fundamental adviser calculator, collaborative tool for real-time analysis and decision-making, and PFM. Additionally, don’t forget about the aggregate information obtained for larger commercial and financial insights.

Strengthens Your Decision-making & Strategy

You may reexamine and modify your financial processes by using financial planning software. It helps you to take more proactive rather than reactive decisions. You may reliably predict the optimum course of action to maximize earnings and expenses with the help of such software.

More Effective Strategic Analysis & Planning

Financial planning software provides advisory firms and clients with a collaborative tool and PFM that allows them to create and evaluate “what if” scenarios, identify new business opportunities, and estimate the likelihood of important external and market trends. The foundation of a successful company strategy is these competencies.

Fewer Mistakes

The program is evolving once more, with more and more clients using it themselves. Even if it is not brand-new, Personal Financial Management (PFM) software is becoming more and more popular as an “Advisor Fintech” option in the wake of the epidemic. It is anticipated that it would become the central location for all pertinent data for customers and advising companies, while also making it easier for clients to manage their own money.

Financial Openness for Shareholders

Future financial planning software development will need to concentrate specifically on each client, company, and market segment from the standpoint of carrying out the duty of the fundamental adviser calculator, collaborative tool for real-time analysis and decision-making, and PFM. Additionally, don’t forget the aggregate information obtained for larger commercial and financial insights.

How do you Create Business Financial Planning Software?

It’s possible that management, vision, and the needs of the software planning software will change. Having said that, a complete software package would include a variety of algorithms to assist and adapt to various clients by providing tailored solutions to plan their investments.

Of course, the idea, designing, programming, and deployment of the software are all part of the development process. However, while developing financial software, the criteria used are crucial and aid in setting the product apart from its rivals.

Select A Software Type – Goal Based vs. Cash Flow Based

Each customer is unique, and so are their requirements. The first step is to select the software type depending on the type of clientele, using the guidance your business provides to customers. It may be divided into two categories: goal-based and cash-flow-based.

The objectives are projected by the goal-based financial planning software based on the investments made. The amount of investment needed to accomplish a necessary aim might be estimated. The total earnings may not be taken into account when determining the needed investment. The cash-flow-based planning software, on the other hand, records every dollar generated and offers recommendations on investments based on projected goals.

Interactive Technologies vs Printed Reports in the Delivery Module

We are rapidly going toward paperless settings thanks to digitalization. The program must offer a user-friendly interactive feature that can display results immediately on clients’ mobile and tablet devices. The program should make cooperation possible by providing instant access to assumed modifications and anticipated outcomes.

Customer-Focused Improvements

The fundamental element demanded in any financial planning software is the ability to comprehend, serve, and locate new clients. The program must allow the adviser to serve customers of any cadre, whether they are HNIs or novices. The software must be able to adapt the investment solution offered by the advising businesses to the preferences and background of the customer.

Effortless Input

Inputting certain fundamental data, such as earnings, savings, and other investments, is expected to result in financial planning software producing an output that is reasonable and practical in terms of the investment. The design procedure should be meticulously planned for smooth functioning in order to guarantee the same. Modular financial planning tools like stock options, tax planning, and a variety of insurances must also be included in the design.

Platforms and Plugins with Reason

Given that not all users will be equally tech-savvy, it will be necessary to offer a feature that allows personal financial planning solutions to be integrated. On all platforms, including PCs, mobile devices, and more, the program should function properly.

Choose the Technology Stack

Technology is crucial to the development of reliable software. The following is the fundamental tech stack needed to create financial planning software:

- Frontend – HTML, CSS, JavaScript, TypeScript

- Backend – Python, C++, C#, Ruby

- Database – SQL, NoSQL

Add the Security Components

Financial planning software is using cloud-based technologies for a number of compelling reasons. Keeping the security settings tight is essential since the data being gathered and processed comes from several sources and is enormous. It is important to keep this in mind during the whole development process.

Develop a Custom Financial Planning Software with Hire Dedicated Resources

The financial planning software market is demonstrating a sharp upward trend of growth in the financial planning software development sector as the pandemic accelerates online solutions. According to a number of studies, North America is anticipated to have the sector’s greatest revenue share. The moment has come to take advantage of the chances.

An expert financial software development company like Hire Dedicated Resources can assist you in creating a platform that can serve as a reliable collaborative tool for you to present your financial planning advice to clients, whether you want to upgrade the current application you are using or build one from scratch.

Hire Dedicated Resources also adds cutting-edge, ground-breaking feature sets to our bespoke software development services to assist your business reach its financial planning and development objectives.

Therefore, our specialists will offer a solution that is suited to your goals and objectives, whether you’re searching for a goal-based solution or a cash flow-based one.